Products

WATERFUND I INSIGHTS

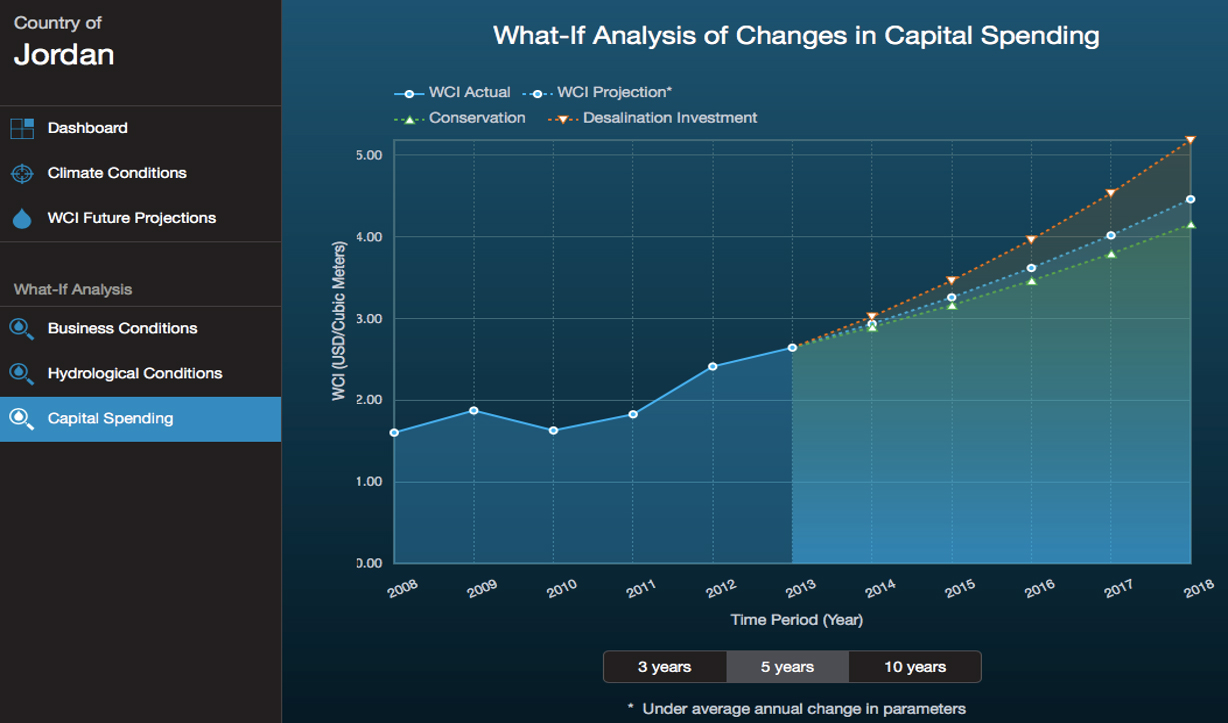

- Optimize capital investment and cash flow

- Model the financial impact of drought and flood

- Objective Tariff Recommendations

- Non-Revenue Water Savings Calculator

- Start today with Free Water Cost Profile

WATERFUND I INVESTMENTS

- Steady long-term returns

- Investments located in the world's driest regions

- Specialist investor in cutting edge desalination technologies

- Help provide freshwater to the 1 billion people without it

- Water tariffs are rising rapidly to catch up with water's true value

Waterfund and IBM are pioneering the leading financial benchmark for the global water industry. Waterfund also provides investment and risk management to select water finance organizations around the world.

Greater insight into outcomes: enables a holistic view of the financial costs and impact of owning and/or using water-related assets.

Greater efficiency in decision making: widens knowledge of water use impact and demonstrates immediately the benefits of operational behaviour changes.

Greater transparency and auditability: enhanced visualisation allows all stakeholders to observe impacts of water use – managers, shareholders, govt., public

The Rickards Real Cost Water Index calculated by IBM measures the full, unsubsidized cost of water production for specific water agencies and projects, eventually covering over 25% of global GDP.

Throughout the world, the value of water is poorly understood and the data is challenging to collect; the world’s most water scarce countries guard the cost of fresh water as they would other critical state secrets. Globally, the price of water to the consumer is not correlated in any way to the availability of freshwater. In fact, the correlation is negative: For example, Copenhagen, Denmark, a city with vast freshwater resources, charges $8.35 per cubic metre to the consumer, while the Emirate of Dubai, a city with negative recharge rates on groundwater, charges consumers $2.16 per cubic metre. A recent report by the think tank CSIS reveals that the United Arab Emirates in fact spends upwards of US$5 billion annually on water infrastructure and energy costs related to desalination.

Water utilities face the most obvious financial risks from supply disruptions, but there is a long list of other industries in which water availability is critical, including the mining, beverage, chemical, and energy sectors, among many others. At the request of the two largest pension funds in the United States, CalPERS and CalSTRS, the Securities and Exchange Commission (SEC) issued guidance in 2010, backed by SEC enforcement authority, for companies to improve environmental and water-related risk disclosure.