Rickards Real Cost Water Index™ calculated by IBM

(powered by IBM Infosphere BigInsights)

Global Water Cost Indices

Location |

Water Cost Index Q4 2015 in US Dollar (USD) |

% Change from Q3 2015 in US Dollar (USD) |

% Change from Q1 2008 in US Dollar (USD) |

Index % Change Q1 2008 in Local Currency |

|---|---|---|---|---|

| Global | $1.80 | ▼ -4.0% | ▲ 19.4% | ▲ 32.9% |

| London | $2.78 | ▼ -4.0% | ▲ 4.9% | ▲ 33.7% |

| Manila, Philippines | $0.42 | ▲ 1.0% | ▲ 23.8% | ▲ 28.3% |

| Sao Paulo | $1.47 | ▼ -8.0% | ▲ 15.3% | ▲ 32.0% |

| Singapore | $3.65 | ▼ -4.0% | ▲ 54.9% | ▲ 33.0% |

| Uganda | $0.97 | ▼ -5.0% | ▲ 1.1% | ▲ 49.3% |

United States Water Cost Indices

Location |

Water Cost Index Q4 2015 in US Dollar (USD) |

% Change from Q3 2015 in US Dollar (USD) |

% Change from Q1 2008 in US Dollar (USD) |

Index % Change Q1 2008 in Local Currency |

|---|---|---|---|---|

| United States | $1.50 | ▼ -1.0% | ▲ 38.9% | ▲ 38.9% |

| Fresno | $1.07 | 0.0% | ▲ 109.2% | ▲ 109.2% |

| Los Angeles | $0.93 | 0.0% | ▲ 63.4% | ▲ 63.4% |

| Sacramento | $1.03 | 0.0% | ▲ 90.6% | ▲ 90.6% |

| SF Bay Area | $2.64 | 0.0% | ▲ 28.8% | ▲ 28.8% |

| Corpus Christi | $1.19 | 0.0% | ▲ 21.2% | ▲ 21.2% |

| Dallas | $1.09 | ▲ 1.0% | ▲ 44.2% | ▲ 44.2% |

| Houston | $1.42 | 0.0% | ▼ -1.8% | ▼ -1.8% |

| Lubbock | $1.91 | ▼ -4.0% | ▲ 44.5% | ▲ 44.5% |

Waterfund and IBM are developing the Rickards Real Cost Water Index™ (WCI) to benchmark the true cost of water production in individual geographic areas, which includes operating, capital, and “hidden economic” costs. The benchmark is motivated by the fact that there is a huge backlog in water infrastructure investment projects due to a shortage of capital. Governments and private water agencies are increasingly forced to turn to the private sector to fund the construction and maintenance of complex water networks. Unfortunately, due to a variety of hidden costs such as government grants to water agencies, capital markets and private equity do not have a systematic way of pricing and measuring risk in water infrastructure investment projects.

Water Cost Index Computation

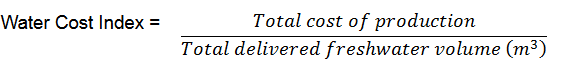

where:

- Total cost of production is calculated as the sum of operating costs, capital costs, and identified subsidies.

- Total delivered freshwater volume(in m3) is the amount the producer reports as delivered, and excludes water lost either due to system leakage, pilfering, or other forms of loss. This penalizes producers with a large fraction of production volume being lost due to system inefficiency.

WCI as Benchmark for Financial Products

The Rickards Real Cost Water Index™ serves as a benchmark for helping measure hundreds of critical projects on a like-for-like basis. Index values reflect estimated water production costs measured in US dollars per cubic meter for a variety of major global water infrastructure projects ranging from retail water utilities to wholesale water utilities. Such a market benchmark will spur the development of next generation financial products for both water producers and investors and to aid the growth of the water sector globally. Here are two examples of how these products would be leveraged:

Scenario 1: A Water Agency cannot obtain bank financing for Phase 2 of a seawater desalination plant project due to previous cost overruns on Phase 1. Yet the Agency lacks the water it needs to supply a contractually specified daily volume of water to its largest customer, with a consequent risk of large penalties for each day of insufficient volume. Using strike and trigger values based on the WCI, the Water Agency could purchase a $25 million, 2 year insurance product. Payout to the Water Agency would be triggered on the total change in its Water Cost Index (as well as some other conditions, such as a specified increase in asset failure costs). This approach would enable the Water Agency to enhance its overall credit profile with the insurance enabled by the WCI, finance Phase 2 of the desalination plant and meet its supply obligations.

Scenario 2: A large desalination and water transmission system project needs to secure private equity and institutional funding alongside that from development banks and sovereign funds, to the tune of one third of the total project cost. To achieve this, the project needs a way to reduce risk to its investors. Based on movement in the WCI, the project could purchase $50 million in insurance. This would enable the insurance product to then be underwritten by a large reinsurer and allow the project to secure the private sector contribution it needs in order to proceed.

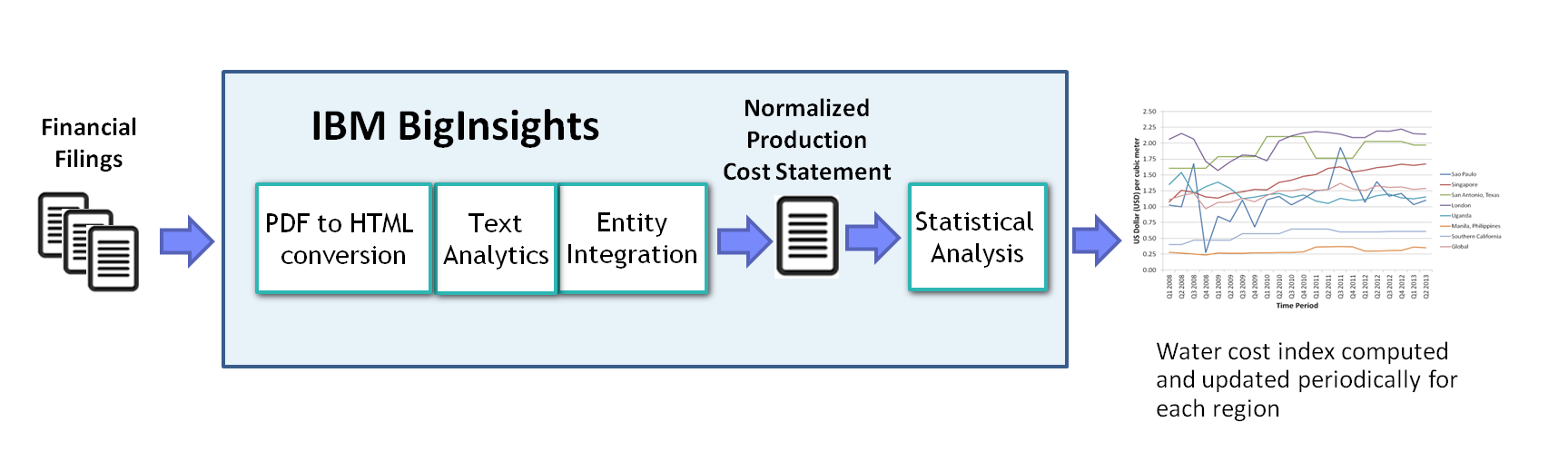

The Water Cost Index is computed using a uniform set of cost variables, called Normalized Production Cost Statement. These statements are constructed from publicly available unstructured financial data by a “calculation agent” developed by researchers in the Accelerated Discovery Lab at IBM Research – Almaden. The cost variables include both direct cost variables (e.g., operating expenses and interest payments) and “hidden economic” costs (e.g., direct payments from the government, interest subsidies, and infrastructure grants). By capturing the “hidden economic” costs as well, the complete cost of producing and supplying fresh water becomes evident. Additionally, costs irrelevant to fresh water production, such as tax payments and sewage costs, are excluded. Values for all cost variables are standardized, and have a single, well-defined semantics. This allows for a direct comparison of relevant costs for each producer. The performance of a water producer can now be benchmarked against other producers in the same geographic region or globally. A producer can be benchmarked on individual cost variables as well, which provides additional insight into their cost structure and the relative risk it presents.

Populating the Normalized Production Cost Statement from unstructured public data involves multiple challenges, including analyzing unstructured text data, identifying cost variables and subsidies, accounting for filing discrepancies, and addressing missing information. Powered by IBM Infosphere BigInsights platform, researchers in IBM Research - Almaden have developed a Calculation Agent leveraging advanced analytics capabilities (unstructured text analytics, entity integration, and statistical analysis), as outlined in the underlying architecture below.

Challenges

Computing the Rickards Real Cost Water Index™ requires addressing the following challenges

Analyzing Unstructured Public Data: A key source of financial information is the audited financial reports that individual agencies publish periodically for the benefit of their shareholders, financiers, or general public. These documents are usually text documents (in pdf or html format) that need to be analyzed to identify the financial information reported within various sections of large (100+ page) documents. These documents are typically for human consumption and processing them programatically raises multiple challenges such as the ability to accurately analyze various concepts of interest such as financial tables or footnotes mentioning cost variables, and the need to process various types of text documents.

Isolating cost variables and identifying both direct and indirect cost subsidies: The cost variables that contribute to the true cost of production are reported in various parts of the financial statements depending on whether they are "explicitly reported costs" or "hidden costs". For instance, operating expenses is typically reported as expenditure in the Income Statement, while government grants may be reported as revenue in the Income Statement; further breakdown of individual costs such as operating expenses may be elaborated in textual notes associated with the financial statements. The ability to extract the individual cost variables from various parts of the reports, and combine them from multiple filings over time to create a complete temporal view for each producer is important.

Accounting for filing discrepancies: Agencies occasionally change, over time, their reporting formats or the way in which they break down specific financial details. The ability to identify these discrepancies while combining data from multiple filings and resolving them, either programmatically or through intelligent alerting of a data steward, is a key requirement.

Addressing missing information: Agencies report their financial information periodically, usually quarterly or annually, and even this information is typically available only after a lag of a few months. Therefore, the last available financial report could be over a year old in many cases. Additionally, data reported in financial statements may be incomplete (e.g., the cost of raw water may not be reported, and must be estimated). In order to have a complete and up-to-date Water Cost Index for all regions, it is imperative to address this missing data problem by estimating the missing values using advanced statistical techniques.

Architecture

PDF Document Processing creates a workflow to convert financial filings from PDF format to HTML using state-of-the-art PDF document processing capabilities

Text Analytics is used to extract values of cost variables from the unstructured text in financial filings for each producer.

Entity Integration combines extracted cost variable values from multiple filings over time to create a complete temporal view for each producer. This step also validates cost variables to identify potentially incorrect values and supports data curation to correct errors.

Statistical Analysis addresses missing data by using statistical techniques to create estimated values enabling (a) index computation till present for all agencies even if the last publicly available financial report is several months in the past, (b) cost variable estimation for all prior periods, even if the data from published financial reports was incomplete, and (c) index computation for finer time granularities.

About IBM Infosphere BigInsights

For more information please visit IBM Infosphere BigInsights

About IBM Research Accelerated Discovery Lab

For more information please visit IBM Research Accelerated Discovery Lab

About IBM Smarter Water

For more information please visit www.ibm.com/smarterplanet/water

About Waterfund

Waterfund is a leader in global water risk management. By pioneering the first flexibly tailored financial products benchmarked to the cost of water production, decision makers no longer have to subsidize water to the detriment of investment in infrastructure. A range of data products and index-linked insurance solutions are now available. Visit www.worldswaterfund.com